Corporate Carbon Reporting Trends for 2025

Introduction

Carbon reporting has evolved from a niche CSR activity to a strategic priority. As climate risks intensify and regulations grow stricter, businesses must upgrade their approach. Transparent carbon reporting is now essential for investor trust, compliance, and long-term value. This article highlights the major carbon reporting trends businesses need to act on in 2025 and beyond.

The Regulatory Shift Toward Mandatory Reporting

Voluntary disclosures are no longer enough. Governments across the EU, US, and Asia are enforcing mandatory climate disclosures. The EU’s CSRD requires companies to report on Scope 1, 2, and 3 emissions with verifiable data. In the US, the SEC is introducing similar measures. Companies failing to comply risk fines, reputational damage, and reduced investor interest.

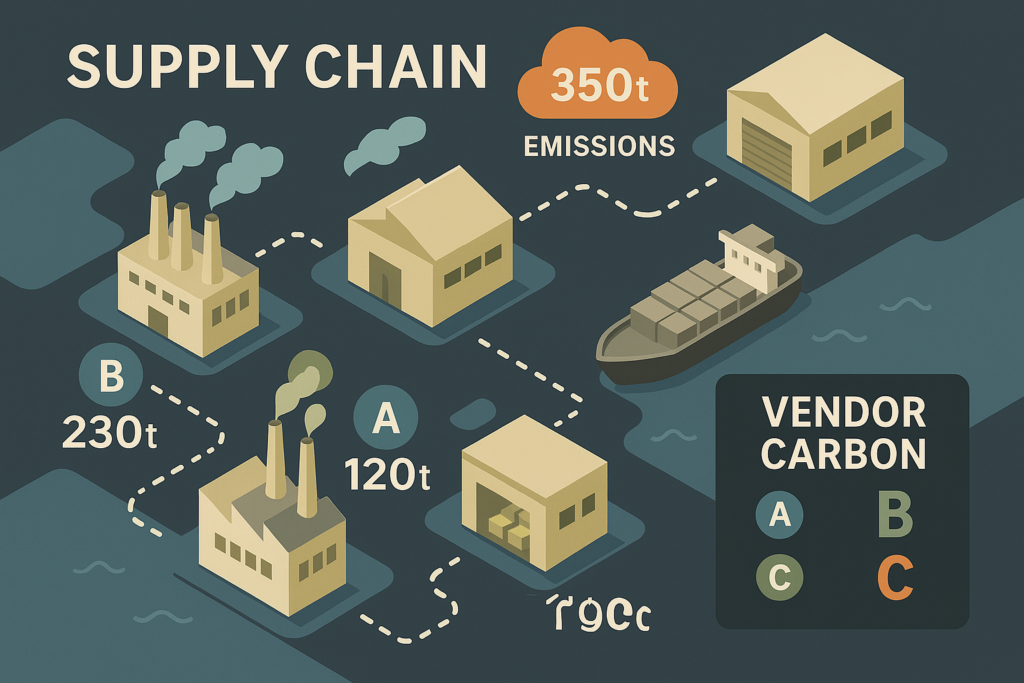

Rise of Scope 3 Reporting Standards

Scope 3 emissions often account for over 70% of a company’s footprint. In 2025, more companies are prioritizing supplier engagement and product lifecycle tracking. Tools like Net0, Emitwise, and Normative help businesses collect Scope 3 data with greater accuracy. In contrast to previous years, ignoring indirect emissions is no longer viable.

ALSO READ

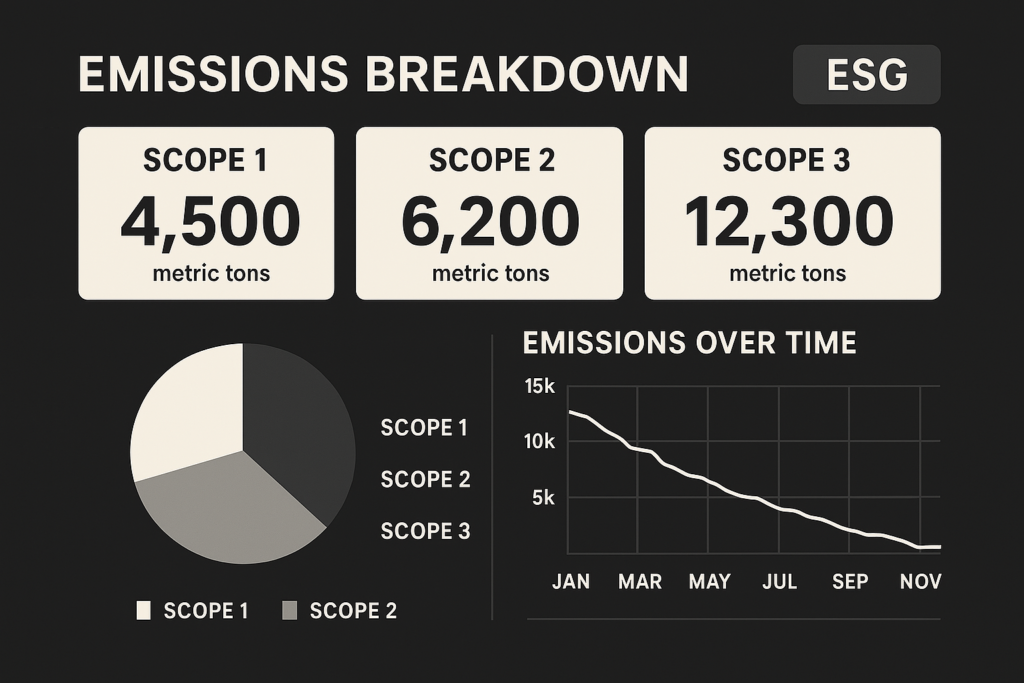

ESG-Linked Carbon Dashboards

Real-time data tools are changing how emissions are tracked and shared. ESG-integrated carbon dashboards provide executives and auditors with live updates. Businesses now embed carbon metrics into financial reports and quarterly updates. As a result, sustainability becomes part of core strategy, not just a side note.

AI-Powered Accuracy and Automation

Artificial Intelligence is streamlining data collection. Companies are using AI to parse invoices, estimate emissions from procurement, and flag anomalies. This helps eliminate guesswork and manual errors. Verified emissions data now powers compliance reports, internal targets, and investor disclosures.

Carbon Reporting in Supply Chain Contracts

Procurement teams are integrating emissions KPIs into contracts. Vendors are asked to report their emissions and use approved tracking tools. This extends carbon accountability across the value chain. Notably, some firms now rank suppliers based on carbon transparency.

Integration with Financial and ESG Reporting

Carbon data is no longer siloed. Companies now integrate emissions data with ESG reports and financial statements. This unifies climate risk with business risk. Investors want to see not only emissions totals but also their financial implications. Accurate carbon reporting supports better forecasting and scenario planning.

Trends in Third-Party Verification

To avoid greenwashing, third-party audits are becoming the norm. Verified reporting builds stakeholder trust and enhances credibility. Platforms offering built-in audit trails and assurance-ready data are gaining popularity. Some regulations now require limited assurance or full verification from accredited bodies.

Preparing for Real-Time Carbon Audits

In the near future, audits will shift from annual reviews to real-time assessments. Automated carbon dashboards, API integrations, and immutable logs will allow live verification. Businesses that invest in this tech now will stay ahead of regulatory timelines.

Conclusion: From Reporting to Responsibility

Corporate carbon reporting is no longer just about metrics. It’s about responsibility, transparency, and leadership. In 2025, the companies that embed accurate emissions data into decision-making will be better positioned to navigate both regulatory and market pressures. Carbon data is becoming a strategic asset, and leaders treat it that way.

Call to Action

📊 Download our free Carbon Reporting Readiness Checklist to make sure your business is audit-ready, CSRD-compliant, and ESG-integrated.