What Is the Difference Between Carbon-Neutral, Net-Zero, and Climate Positive?

With climate commitments now essential to every business’s plan, we’re constantly hearing the phrases carbon-neutral, net-zero, and climate positive. If you’ve felt a bit overwhelmed or confused by them, you’re not alone. The truth is, these terms are frequently misunderstood or, worse, treated as synonyms. This lack of clarity makes it incredibly difficult for companies to set clear targets, for investors to trust ESG reporting, and for consumers to know if a brand is truly walking the talk.

Getting these concepts right is the first and most vital step toward creating an honest climate strategy and staying compliant with respected frameworks like the Science Based Targets initiative.

In this article, let’s define each term simply, show you exactly how they differ, and provide a clear roadmap for what your business must do to genuinely meet these standards.

Carbon-Neutral vs Net-Zero vs Climate Positive: Why the Distinction Matters

Before diving into each definition, here’s the simplest way to understand the hierarchy:

Carbon-Neutral: You compensate for emissions.

Net-Zero: You eliminate emissions to near-zero before offsetting the rest.

Climate Positive: You remove more carbon than you emit.

These terms represent increasing levels of climate commitment. But the details and implications are where the real difference lies.

1. What Does Carbon-Neutral Mean?

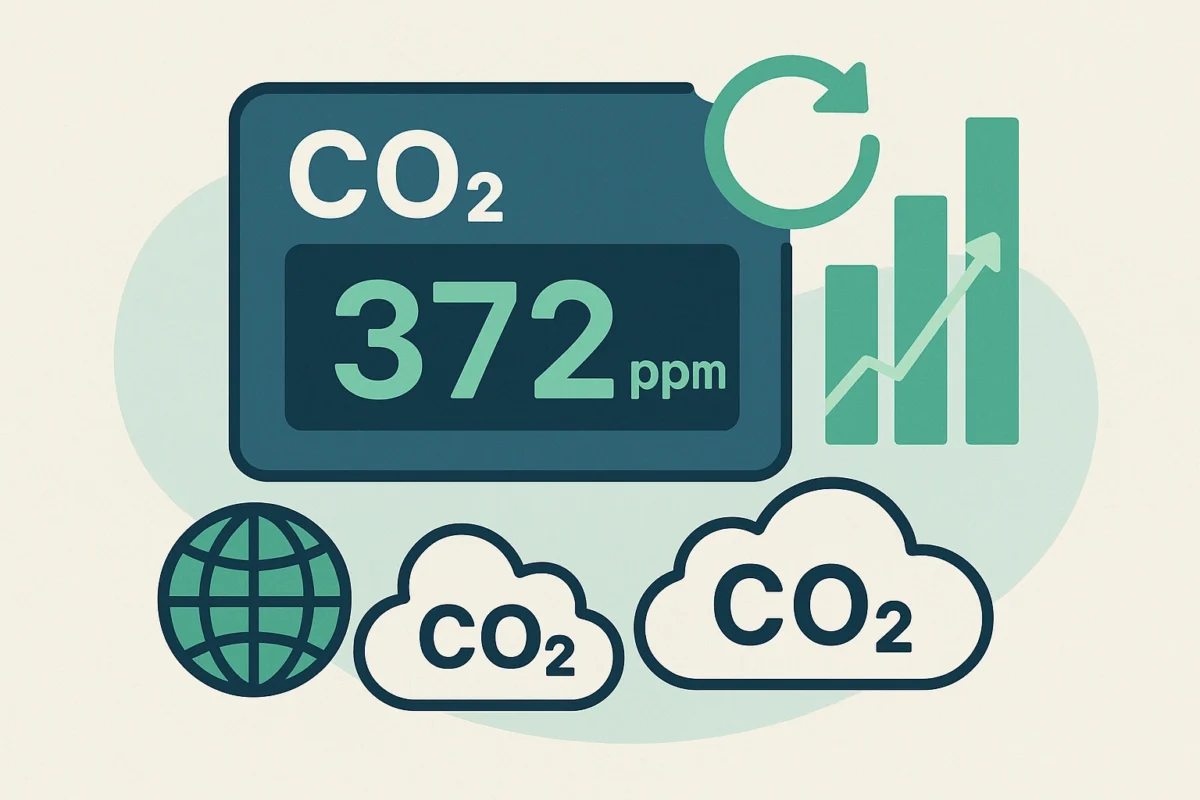

A company is carbon-neutral when it measures its emissions and offsets the equivalent amount through verified carbon credits.

Essentially it means, emissions (any amount) – Carbon Offsets = Net Carbon Output of 0

This does not require the company to reduce its emissions first. It only requires accurate measurement and offset purchases.

How Companies Achieve Carbon Neutrality

To claim carbon neutrality, businesses typically take these steps:

Calculate total emissions (Scopes 1, 2, and often parts of Scope 3).

Purchase carbon credits from projects like:

- Reforestation

- Renewable energy development

- Methane capture

- Verified carbon removal technologies

- Submit claims to third-party verifiers (e.g., PAS 2060).

Carbon neutrality allows flexibility and speed, which is why many companies adopt it as a short-term climate target.

Limitations of Carbon Neutrality

While valuable, carbon neutrality has its critics. The main concerns are:

- Companies can offset without reducing emissions.

- Some offsets lack transparency or permanence.

- It may delay real decarbonization.

- This is why investors and regulators increasingly prefer net-zero goals.

Also See: Neural Networks of Nature: How Deep Learning Decodes Emission Patterns

2. What Does Net-Zero Mean?

A company reaches net-zero when it reduces emissions across its entire value chain to as close to zero as scientifically possible—and only offsets residual emissions that cannot be eliminated.

This aligns with IPCC guidance, which requires:

- 90–95% real reductions

- 5–10% neutralization via carbon removal, not avoidance credits

Net-zero isn’t just about balancing emissions, it’s about fundamentally transforming operations.

Net-Zero Requirements for Businesses

To meet credible net-zero goals, companies need:

1. Science-based decarbonization

Reduction targets aligned with:

- SBTi Net-Zero Standard

- Paris Agreement’s 1.5°C pathway

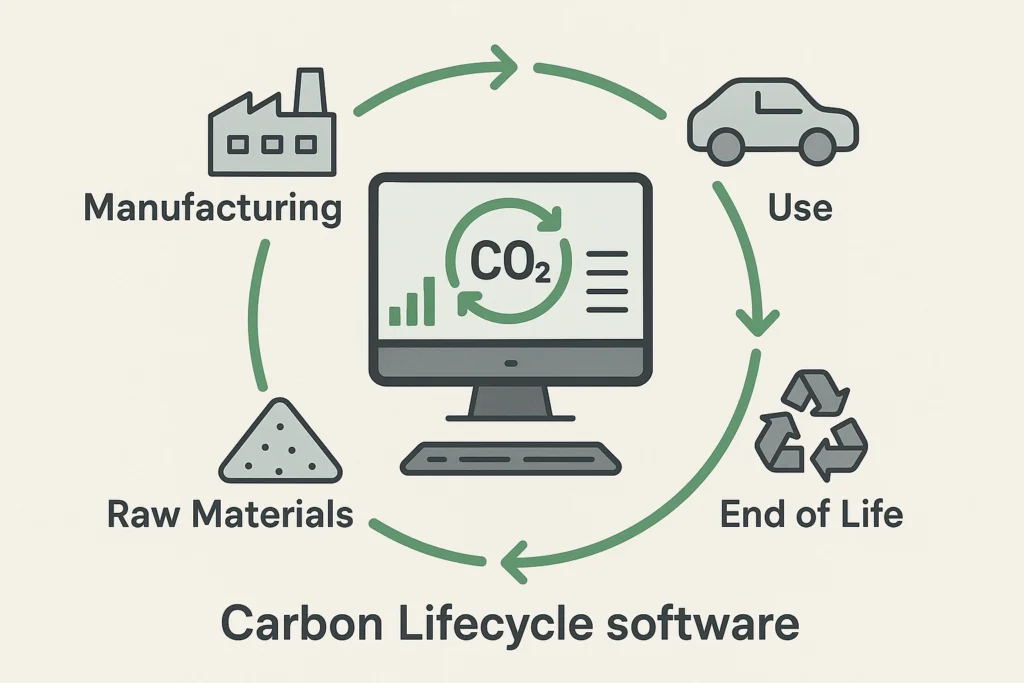

2. Full value chain coverage

Net-zero also demands full value-chain coverage. Companies must measure and reduce emissions across Scopes 1, 2, and 3. Since Scope 3 often makes up most of a company’s footprint, this means working closely with suppliers, partners, and product lifecycles.

3. Residual emissions neutralization

Finally, net-zero includes a small portion of residual emissions that can’t be eliminated yet. These must be neutralized using high-quality carbon removal solutions, such as direct air capture, verified reforestation, or biochar.

Why Net-Zero Is More Credible Than Carbon Neutral

Net-zero requires systemic change, including:

- Clean energy adoption

- Supplier emissions reduction

- Low-carbon logistics

- Product redesign

- Circular manufacturing

In short, carbon-neutral compensates, net-zero transforms.

3. What Does Climate Positive Mean?

A company becomes climate positive (also known as “carbon negative”) when it removes more carbon from the atmosphere than it emits.

Formula: Carbon Removed > Carbon Emitted

Climate positive represents the highest level of climate ambition.

How Businesses Achieve Climate Positive Status

To move beyond net-zero, companies must:

- Reach net-zero emissions first

- Continue investing in carbon removal projects that exceed their own footprint

- Enhance natural carbon sinks through land, ocean, and biodiversity projects

- Support global decarbonization initiatives beyond internal reductions

For example, Microsoft committed to removing all historical emissions by 2050.

Why Climate Positive Is the Future of Corporate Sustainability

Climate positive action goes beyond basic responsibility, it’s a strategic advantage for modern companies. It strengthens brand leadership, builds deeper trust with stakeholders, and creates a buffer against rising carbon taxes.

By removing more emissions than they produce, climate-positive businesses also play a meaningful role in supporting global climate goals during the most critical decades ahead. As regulations tighten and expectations rise, this approach is quickly becoming the new benchmark for corporate sustainability.

Understanding the Role of Carbon Offsetting

Many businesses confuse carbon-neutral vs net-zero because of carbon offsetting.

Here’s the critical distinction:

Carbon-neutral: Offsetting is the primary solution.

Net-zero: Offsetting is a last resort after major reductions.

Climate positive: Offsetting is used to go beyond neutrality.

Which Goal Should Businesses Choose?

Businesses should choose their climate goal based on how mature their sustainability strategy is. Carbon neutrality is the most practical starting point, especially for companies building early-stage programs or looking for quick wins in ESG visibility.

As they progress, net-zero becomes the natural next step, offering deeper emission cuts and stronger alignment with investor expectations and regulatory trends.

For organizations aiming to lead their industry, the long-term target is climate positive, going beyond neutral to actively remove more carbon than they emit and contributing to broader climate restoration efforts.

FAQ: Carbon-Neutral, Net-Zero, and Climate Positive

1. Is carbon-neutral the same as net-zero?

No. Carbon-neutral relies on offsets. Net-zero requires deep emission reductions before using a small amount of carbon removal.

2. Can a company be climate positive without being net-zero first?

No. Climate positive requires reaching net-zero first, then removing additional carbon.

3. Are carbon offsets reliable?

Offsets vary in quality. High-integrity removal offsets are required for net-zero under SBTi standards.

4. Do all companies need to tackle Scope 3 emissions?

For net-zero and climate positive, yes. For carbon-neutral often optional.

5. Which term do regulators prefer?

Net-zero is the gold standard for regulatory and investor reporting systems.

Conclusion

The difference between carbon-neutral, net-zero, and climate positive is that it defines the credibility and depth of a company’s climate impact. While carbon neutrality is a good starting point, net-zero represents true transformation. Climate positive goes even further, supporting global climate repair.

For businesses aiming to lead in sustainability, understanding (and correctly applying) these terms is essential. The world is moving toward stricter science-aligned frameworks, and companies that align early will gain both environmental and economic advantages.