Machine Learning in Carbon Accounting: Predicting Emission Trends

Measuring carbon emissions just doesn’t cut it anymore. With global climate targets getting tighter, businesses need to stop just tracking what they’ve already done and start predicting what’s coming next. This is where machine learning (ML) steps into carbon accounting. It’s where serious data science meets environmental action. Machine learning emissions models are the secret weapon, chewing through years of emissions data, energy use records, and supply chain metrics to spot trends no human could find.

These predictive insights allow companies to get ahead of their climate goals and take proactive action instead of scrambling after the fact. From smart ESG software to advanced carbon data analytics, ML is fundamentally changing how organizations measure, report, and, most importantly, forecast their emissions.

In this article, let’s explore exactly how this carbon accounting AI works, what it can predict, and why it’s fast becoming a non-negotiable tool for any climate-smart business.

What Is Machine Learning in Carbon Accounting?

Carbon accounting traditionally involves collecting data on energy consumption, waste, transportation, and production to calculate carbon output. But this process often stops at reporting as it tells companies where they stand today, not where they’re headed tomorrow.

Machine learning changes that. Instead of static analysis, ML models continuously learn from real-time data sources like sensor readings, supply chain reports, and external environmental datasets. By recognizing patterns in emissions analytics, machine learning algorithms forecast how future activities will influence carbon output.

In simple terms, machine learning turns carbon accounting from a rearview mirror into a predictive dashboard.

Why Predictive Carbon Accounting Matters

Climate change doesn’t happen linearly. Sudden regulatory shifts, market changes, and energy fluctuations can alter emissions overnight. Companies using carbon trend prediction tools have a major advantage as they can simulate outcomes before they occur. Predictive carbon accounting helps in:

Regulatory Readiness: Governments are moving toward mandatory climate disclosures. Predictive tools ensure compliance well before regulations take effect.

Cost Management: Energy prices and carbon taxes fluctuate. Forecasting emissions helps businesses adjust operations to avoid unexpected expenses.

Operational Efficiency: Predictive data reveals inefficiencies early, from underperforming equipment to high-emission routes.

Climate Accountability: Stakeholders now demand transparency. AI-backed reports strengthen trust through data accuracy and future-proof planning.

Also See: What is Carbon Accounting? A Comprehensive Guide

How Machine Learning Predicts Emission Trends

1. Data Collection in Machine Learning Emissions

Machine learning thrives on data volume and diversity. Carbon AI tech pulls in structured and unstructured data from across the organization:

- Smart meters tracking electricity and gas usage

- IoT devices in logistics monitoring transport emissions

- Supplier carbon disclosures

- Weather and climate models

- Satellite imagery for land-use analysis

These datasets form the foundation of predictive modeling.

2. Feature Engineering

Next, AI systems identify which data points or features most strongly influence emissions. For example, production volume, machine temperature, or fuel type. This step ensures that the model focuses on what really drives carbon output.

3. Model Training

Using historical emissions data, ML models are trained to recognize cause-and-effect patterns. Techniques like regression analysis, decision trees, and neural networks learn how certain actions affect future emissions.

4. Prediction and Optimization

Once trained, the model starts generating forecasts. It predicts future carbon output based on operational plans, resource use, or seasonal variations. More advanced systems also suggest optimization paths, showing which changes would reduce emissions most efficiently.

5. Continuous Learning

Unlike static reports, ML-based systems evolve. Each new data point refines the algorithm’s accuracy. Over time, the software becomes more precise, adapting to both internal changes and global climate trends.

Key Applications of Machine Learning Emissions in Carbon Accounting

Let’s take a look at how ML in carbon accounting is being used:

1. Emissions Forecasting

This is the core use case. ML models predict short-term and long-term emission trends, allowing companies to adjust strategies proactively.

2. Supply Chain Optimization

Machine learning analyzes supplier data to identify high-emission vendors. It then models the impact of switching to greener partners which is a major win for Scope 3 tracking.

3. Energy Efficiency Modeling

AI identifies machines or facilities consuming more power than expected. Predictive insights enable preventive maintenance, lowering both emissions and energy bills.

4. Investment Planning

Through ESG predictive analytics, companies can assess the carbon payback period of sustainability investments from renewable energy adoption to fleet electrification.

5. Carbon Credit and Offset Analysis

AI tools evaluate the quality and performance of carbon offsets by comparing forecasted reductions with real-world outcomes, ensuring transparency and accountability.

Benefits of Using Machine Learning Emissions in Carbon Accounting

1. Higher Accuracy and Precision

Human error, estimation gaps, and outdated data often plague traditional carbon accounting. ML models use real-time data streams and multi-variable correlations to produce more reliable results.

2. Proactive Decision-Making

With predictive insights, companies can shift from reacting to anticipating. Instead of waiting for annual ESG reports, teams can course-correct operations in real time.

3. Simplified ESG Compliance

AI-powered tools automatically align emission data with frameworks like GHG Protocol or CDP, reducing manual work and reporting errors.

4. Cost and Resource Efficiency

Predictive modeling highlights inefficiencies across logistics, energy consumption, and production. Correcting them lowers emissions and operational costs simultaneously.

5. Climate Risk Resilience

By simulating multiple climate or regulatory scenarios, AI ESG software helps organizations understand vulnerabilities and build long-term resilience into their operations.

Challenges in AI-Powered Carbon Accounting

Despite its advantages, ML-based carbon tracking has hurdles like:

Data Fragmentation: Many companies still store emissions data in silos, making unified analysis difficult.

Algorithm Transparency: Some machine learning models operate as “black boxes.” Without explainability, it’s hard for auditors to verify results.

Data Quality Issues: Inaccurate or incomplete data weakens predictions. Data integrity is crucial.

Integration Complexity: Incorporating ML into existing carbon accounting systems often requires IT upgrades and skilled personnel.

These challenges are real but surmountable with proper data governance, open-source AI models, and scalable infrastructure.

The Future of Machine Learning Emissions Accounting

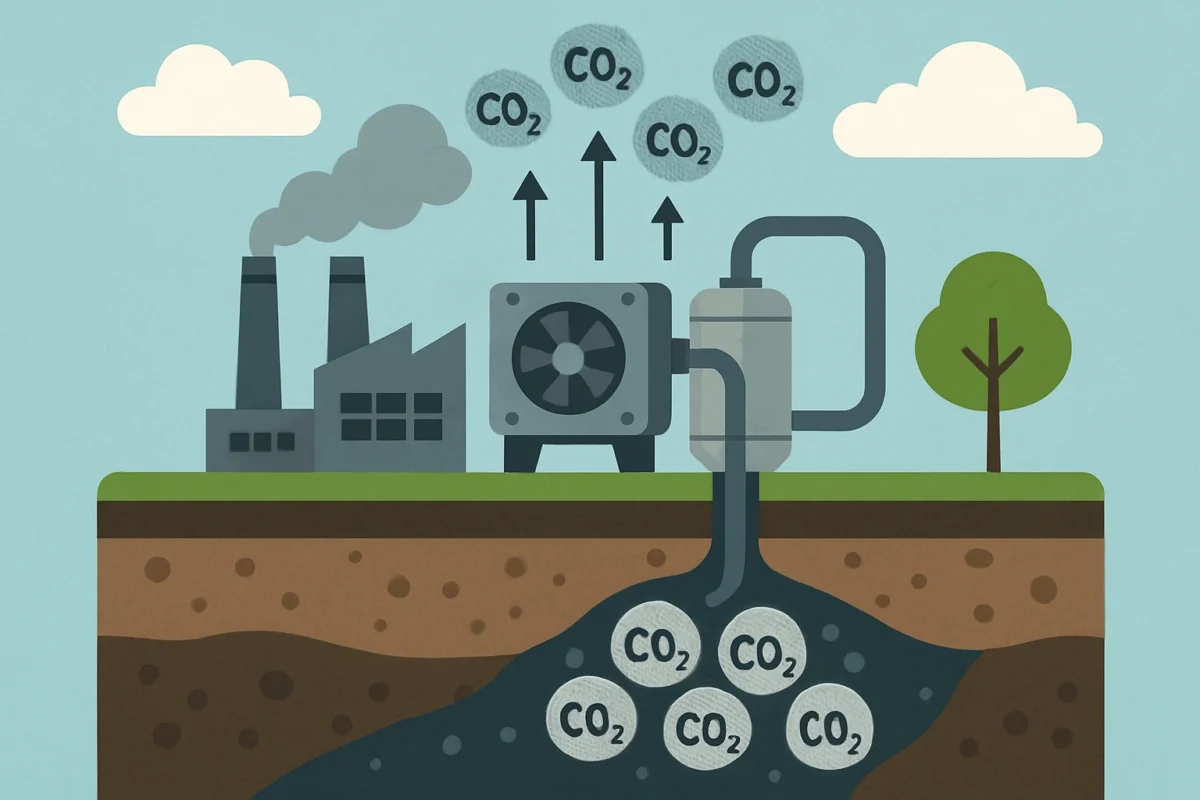

The next generation of carbon AI tech will combine predictive modeling with automation and blockchain-based verification. Imagine ESG systems that not only forecast emissions but also execute automated actions like adjusting power loads or rebalancing supply chains to stay within targets.

Emerging technologies like federated learning will enable global collaboration without compromising data privacy, letting organizations train shared AI models using distributed data. Meanwhile, integrating carbon data with financial systems will turn sustainability into a real-time balance sheet metric, not just an annual report.

FAQ: Machine Learning Emissions Accounting

How does machine learning improve emissions forecasting accuracy?

Machine learning processes massive datasets and identifies non-obvious patterns, making forecasts far more accurate than manual estimates.

Is AI carbon accounting only for large corporations?

No. Cloud-based tools now make predictive carbon tracking affordable for small and mid-sized businesses as well.

Can ML predict regulatory risks?

Yes. Some systems simulate how upcoming carbon laws or pricing changes could impact operations and costs.

What’s the difference between AI ESG software and traditional carbon tools?

Traditional tools record and report emissions. AI-driven systems learn, predict, and optimize continuously for better outcomes.

How does predictive carbon data support sustainability reporting?

It provides a forward-looking narrative, allowing businesses to set and validate realistic reduction targets supported by science-based data.

Conclusion

Machine learning in carbon accounting marks a major step toward proactive climate management. By combining data precision with predictive analytics, AI empowers businesses to anticipate emission trends, optimize operations, and strengthen ESG compliance.

As the climate economy matures, the winners will be those who understand that carbon accountability is not just about what’s emitted — it’s about what can be prevented. With emissions forecasting powered by machine learning, sustainability becomes not just measurable but predictable.