A Look into Different Carbon Accounting Methods

As global awareness of climate change increases, businesses are under growing pressure to measure and reduce their carbon emissions. One of the most effective ways for organizations to achieve this is through carbon accounting. By tracking and measuring emissions, businesses can better understand their environmental impact and develop strategies to reduce their carbon footprint.

However, not all carbon accounting methods are the same. Different methods allow businesses to track emissions at varying levels of detail, from simple estimates to comprehensive lifecycle assessments. In this article, we will explore several carbon accounting methods that businesses can use to measure and report their carbon emissions. Understanding these methods is essential for businesses striving to meet sustainability targets and contribute positively to the environment.

What is Carbon Accounting?

Carbon accounting is the process of measuring, managing, and reporting the greenhouse gas (GHG) emissions generated by a business or organization. The goal is to track emissions from various activities, including energy consumption, transportation, waste generation, and product lifecycle, and to identify opportunities for reducing the environmental impact.

There are multiple methods available for carbon accounting, each suited to different business needs. The method a company chooses depends on the complexity of its operations, regulatory requirements, and sustainability goals.

Types of Carbon Accounting Methods

There are several key carbon accounting methods, each with its own approach to calculating emissions. The most common methods include:

1. The Greenhouse Gas (GHG) Protocol

The GHG Protocol is one of the most widely adopted carbon accounting frameworks globally. It provides comprehensive guidelines for businesses to measure and manage greenhouse gas emissions from their operations.

The GHG Protocol divides emissions into three categories, or scopes:

- Scope 1: Direct emissions from owned or controlled sources, such as fuel combustion in company vehicles or production facilities.

- Scope 2: Indirect emissions from the generation of purchased electricity consumed by the organization.

- Scope 3: Other indirect emissions, including emissions from the supply chain, business travel, waste disposal, and the use of sold products.

The GHG Protocol is widely recognized and is the most commonly used method for carbon accounting by businesses of all sizes. It provides companies with a clear framework to calculate their carbon footprint and ensure regulatory compliance.

Benefits of the GHG Protocol:

- Comprehensive framework for all types of emissions

- Widely accepted by governments, regulators, and businesses globally

- Allows for transparency in emissions reporting and measurement

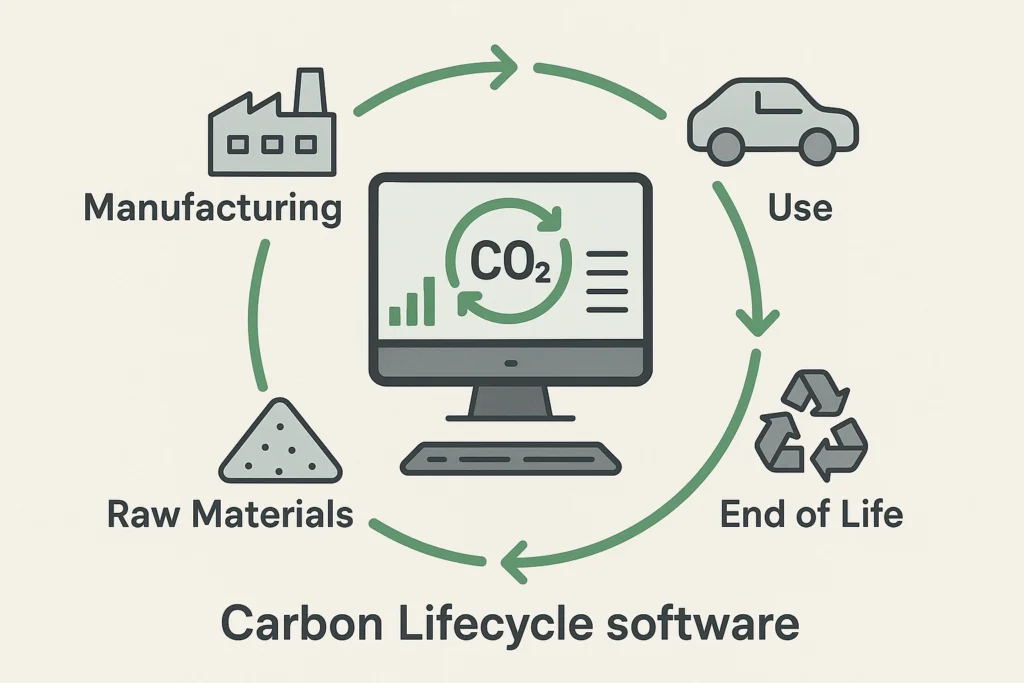

2. Life Cycle Assessment (LCA)

Life Cycle Assessment (LCA) is a more in-depth method of carbon accounting that analyzes the environmental impact of a product or service from cradle to grave. This means that LCA tracks the environmental impact of a product throughout its entire lifecycle, from raw material extraction and manufacturing to usage and disposal.

LCA is particularly useful for businesses in product-centric industries such as manufacturing, construction, and retail, as it helps them understand the carbon emissions associated with each stage of the product’s life.

Benefits of Life Cycle Assessment:

- Provides a holistic view of a product’s carbon footprint

- Helps businesses identify high-impact areas in the supply chain and product usage

- Enables more informed decision-making regarding product design and material choices

3. Carbon Footprint Analysis

Carbon footprint analysis is a method that involves measuring the total amount of greenhouse gases emitted by an organization, product, or service. This method focuses on calculating the carbon footprint of business operations and provides a snapshot of an organization’s emissions.

Businesses can perform a carbon footprint analysis using a variety of tools and software. These tools often use data from energy consumption, transportation, waste production, and other sources to calculate the total emissions produced.

Benefits of Carbon Footprint Analysis:

- Quick and straightforward method for businesses to calculate emissions

- Provides businesses with actionable data to reduce energy consumption and improve energy efficiency

- Ideal for businesses looking for a simple method of measuring their carbon footprint

4. The Carbon Trust Standard

The Carbon Trust Standard is a certification awarded to businesses that have achieved significant reductions in carbon emissions over time. The process involves verifying a company’s carbon footprint and assessing the effectiveness of its carbon reduction efforts.

The Carbon Trust Standard is designed to help businesses measure and manage carbon emissions while also improving energy efficiency and reducing environmental impact. By receiving this certification, businesses demonstrate their commitment to sustainability and environmental responsibility.

Benefits of the Carbon Trust Standard:

- Offers a third-party certification that proves a business’s commitment to sustainability

- Focuses on continuous improvement in carbon reduction strategies

- Enhances corporate reputation by showcasing commitment to environmental leadership

5. ISO 14064 Standard

The ISO 14064 is part of the ISO 14000 family of environmental management standards. ISO 14064 provides detailed guidelines for measuring, quantifying, and reporting greenhouse gas emissions at both the organizational level and the project level.

ISO 14064 has three parts:

- Part 1: Defines the requirements for quantifying and reporting emissions

- Part 2: Provides the requirements for quantifying and reporting GHG reductions

- Part 3: Provides guidance for validation and verification of GHG assertions

Benefits of ISO 14064:

- Offers a globally recognized standard for carbon accounting

- Facilitates third-party verification of carbon data

- Supports businesses in their efforts to comply with international sustainability goals

How to Choose the Right Carbon Accounting Method

1. Understand Your Emissions Sources

The first step in selecting the right carbon accounting method is to identify your emissions sources. Are your emissions primarily from energy consumption (Scope 2), or do you have significant emissions in your supply chain (Scope 3)? Understanding where your carbon emissions come from will help determine the most appropriate accounting method.

2. Consider the Complexity of Your Operations

If your business operates in multiple countries or industries with complex supply chains, Life Cycle Assessment (LCA) or the GHG Protocol may be the best methods. These methods provide a comprehensive view of emissions, helping businesses track the carbon footprint of operations and products at every stage.

3. Assess Your Reporting Needs

For businesses needing to meet regulatory reporting requirements, the GHG Protocol and ISO 14064 are excellent options as they align with many international reporting standards. For companies focused on sustainability leadership, certifications like the Carbon Trust Standard can help validate their emissions reduction efforts and demonstrate their commitment to reducing their carbon footprint.

Conclusion

Choosing the right carbon accounting method is crucial for businesses looking to reduce their carbon emissions and contribute to global sustainability goals. Each method offers different levels of detail and focuses on different aspects of carbon emissions. Whether you opt for the simplicity of a carbon footprint analysis, the in-depth analysis of Life Cycle Assessment (LCA), or the comprehensive approach of the GHG Protocol, the key is to ensure that your business tracks its emissions accurately and develops effective strategies for carbon reduction.

By adopting the right carbon accounting methods, businesses can meet regulatory requirements, improve operational efficiency, and build a reputation as a sustainability leader. In an increasingly eco-conscious world, carbon accounting will continue to play a pivotal role in shaping the future of business.

Get Started with Carbon Accounting Today

Ready to start measuring and reducing your carbon footprint? Subscribe to our newsletter for more insights on carbon accounting methods, or download our guide to choosing the best carbon accounting approach for your business.